EXECUTIVE SUMMARY

Robotic process automation (RPA) and artificial intelligence (AI) are revolutionary tools for boosting productivity and improving quality in the financial service industry. RPA is used to automate repetitive, time-consuming tasks that are rules-based with the goal of establishing fully automated end-to-end processes. Moreover, RPA can be the foundation for the broader digital transformation of your business and workforce by enabling the rapid adoption of Machine Learning (ML) and AI tools into your workflow.

INTRODUCTION

Traditional financial services firms are faced with massive challenges due to a dynamic regulatory environment, demand for innovation, and new competitors that are untethered to legacy IT and manual processes. A recent Gartner study states that 85% of large enterprises will deploy RPA in some of their workflow by the end of 2022. Market data services groups at large financial institutions, while responsible for delivering the essential content to front, middle and back-office platforms, are often hampered by manual process that raise cost, reduce service levels, and increase risk for the organization. This paper is focused on highlighting the benefits and potential of RPA and AI in the market data industry.

RPA AND THE PATH TO ARTIFICIAL INTELLIGENCE

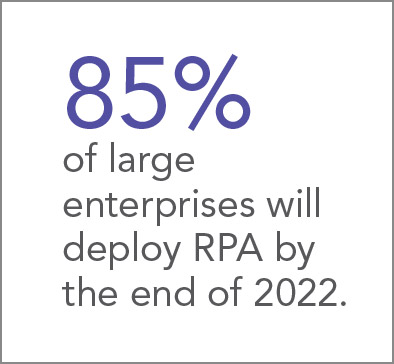

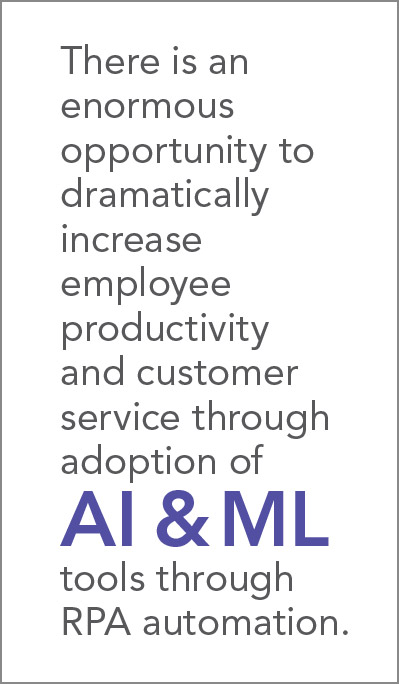

Organizations like Amazon, Google and Facebook invest billions in AI and machine learning technologies to predict shopping and interest patterns focused on driving customer engagement. AI in banking has been largely focused on fraud detection, risk management, and enhancing customer experience. At WHSS, we believe there is an enormous opportunity to dramatically increase employee productivity and customer service through adoption of RPA in conjunction with AI and ML tools. The graphic below suggests one way to look at the evolutionary steps in the adoption of these next generation technologies.

The first level of automation, based largely on rules-based steps that are programmed sequentially, usually with one application keeping all data within a single workflow. The next stage represents robotic process automation. Focused on repetitive, rules-based tasks carried out by humans over multiple applications. One major component of the RPA process is automated handling, parsing, and capturing relevant content from inbound messaging and ticketing systems. We believe the adoption of RPA is a critical first step up the ladder of innovation. RPA in conjunction with AI, ML, Natural Language Processing (NLP), and Optical Character Recognition (OCR) is key to automating the most critical and complex business processes, analysis, and interactions.

THE FORCES DRIVING CHANGE IN TODAY’S BANKING INDUSTRY

As in most industries today, Financial Services are under continuous pressure to meet shareholder expectations and deliver strong profits. A firm’s ability to earn returns above the cost of capital in the long term will depend on whether they can pass on the cost of maintaining the higher capital reserves required by global regulators. The first examples of “internet banking services” were initially supplier driven, but customers quickly got used to engaging directly with their banks and brokers, with their needs anticipated and met across a range of products and services. This evolution of the bank has continued and has been changed exponentially with the advent of mobile banking, changing forever the relationship between bank and customer. FinTech’s across retail, commercial and investment banking are challenging the notion of what a typical bank can do, picking off major business areas within banks that have been largely ignored from an innovation perspective. Areas like payments, once a high margin profit center for legacy banks are now in the crosshairs of small Fintech startups who can streamline the process and offer services for a fraction of the price of big banks. These shifts in demand and competitive pressure are increasing the requirement for traditional banks to improve integration of internal and external services to deliver a high-value data driven experience to this new class of customer. Siloed data and systems can no longer be tolerated as banks compete in this new landscape of competition and heightened customer demands.

As a result of this shift in demand, financial services firms are seeking strategies and tools to seamlessly integrate disparate systems, break down siloed departments to drive innovation and efficiency. Automation through RPA and AI is a priority for those companies looking to retain existing and attract new clients as FinTech continue to challenge the notion of what a financial institution is and can offer.

BENEFITS OF RPA

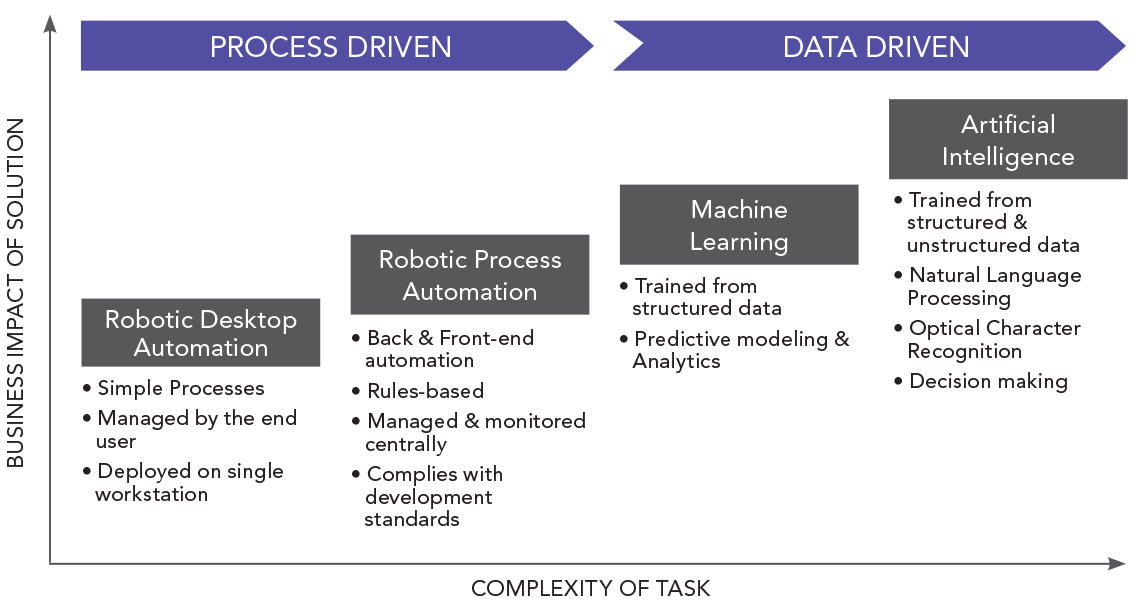

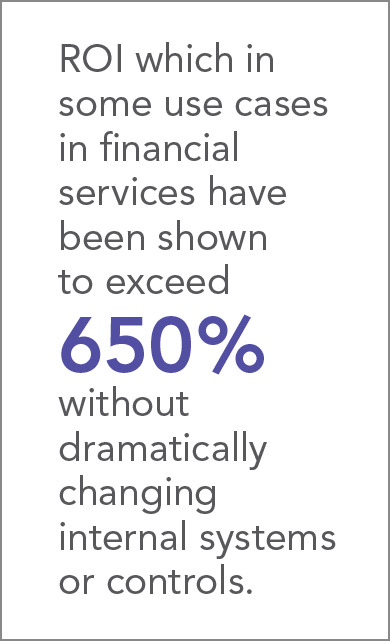

One of the main factors that is driving the adoption of Robotic Process Automation is the very quick Return on Investment (ROI) which in some use cases in financial services have been shown to exceed 650% without dramatically changing internal systems or controls. This is seen as an incredible value when compared to the ROI of other innovation projects like AI alone and blockchain which often have longer value horizons.

Factors that make robotic process automation attractive include

Enhanced Employee Satisfaction: You no longer need to engage your employees in repetitive unskilled tasks like data entry or answering the repetitive queries of customers. RPA’s rules-based automation handles these tasks efficiently, enabling organizations to engage their staff in more value-added tasks that require human intervention and creativity which increases the employees’ sense of satisfaction and connection with their employer and its customers.

Improved Cost Optimization, Productivity, and Scalability: Organizations are under constant pressure to enhance productivity and to get better utilization of their investment capital. RPA can dramatically reduce both CAPEX and OPEX expenses as repetitive tasks move from FTE’s to highly efficient RPA utilities. In addition, RPA can support business demand during periods of higher activity without increasing staff levels.

Reduced Error and Operational Risk: Repetitive and mundane operations that are performed by humans are more susceptible to errors. Today, data has become a firm’s most valuable asset. Ensuring the correct collection and recording of all datasets is critical to a business’s overall strategy and success. RPA is often implemented to assure the efficient and accurate collection of a firm’s most valuable data.

Improved Data Collection: As previously mentioned data is critical to most companies’ success, thus driving the need to increase the collection of a broader dataset. Implementing a change in the type and amount of data collected by customer service representatives is often challenging, requiring significant investment of time and training. RPA changes can be rapidly deployed to better respond to business demands for more data.

Improved Data Collection: As previously mentioned data is critical to most companies’ success, thus driving the need to increase the collection of a broader dataset. Implementing a change in the type and amount of data collected by customer service representatives is often challenging, requiring significant investment of time and training. RPA changes can be rapidly deployed to better respond to business demands for more data.

Improved SLA: RPA can enable and enhance a firm’s ability to meet and exceed customer requirements for round the clock service, support, and an enhanced customer experience.

Better Integration and Operability: RPA enables enhanced integration of operations between front, middle and back-office functions with little or no need to make changes to backend systems or data stores. These functional improvements can be implemented rapidly while maintaining and enhancing existing controls.

Improved Internal Operations: RPA can remove or dramatically reduce the time spent on internal tasks like records management, onboarding and offboarding of employees, attendance tracking, and internal reporting.

Enhanced Security: RPA can dramatically improve security compliance and lower risk of improper access to confidential customer or employee data.

PRACTICAL APPLICATIONS OF RPA IN MARKET DATA SERVICES

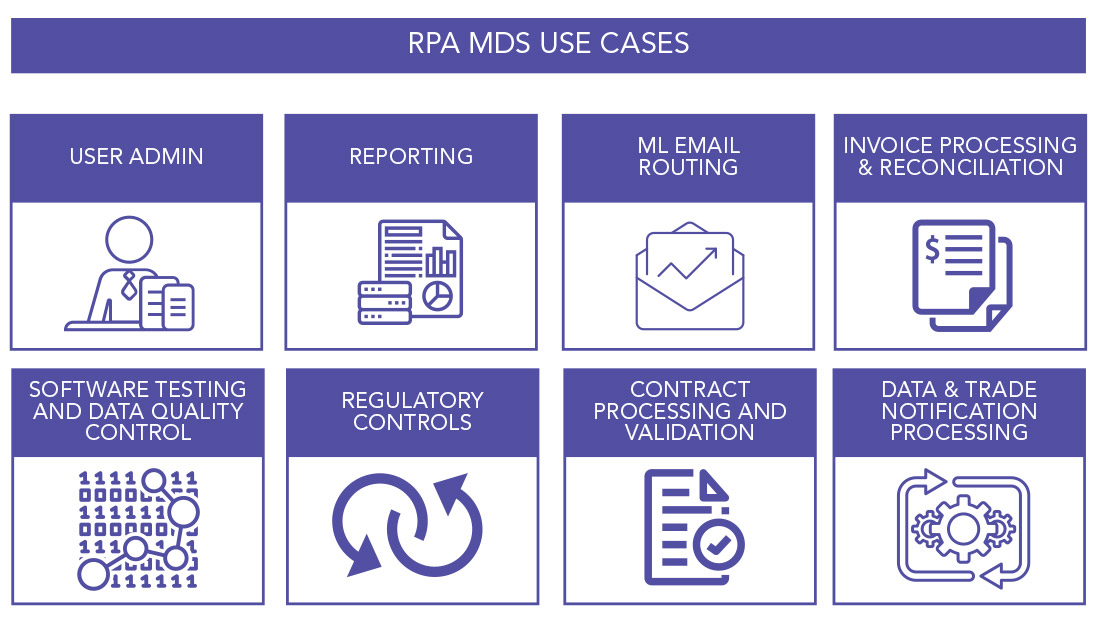

Market Data Services within financial organizations offer a large number of automation opportunities. Successful implementation, however, depends on other factors including central IT, organizational and business unit structure, and the overall maturity of the application development organization. Key focus areas for applying automation to market data services include user and application entitlement and administration, usage reporting, request classification routing and processing, quality control and UAT, and regulatory and compliance reporting.

OPTIMIZING REQUEST MANAGEMENT

One key factor to the successful adoption of RPA in an organization is the efficient handling of inbound service requests and interactions from business units, vendors, and exchanges. These interactions usually begin with an email, ticketing or file-based correspondence like a spreadsheet or PDF. Inbound documents are classified and elementized with a combination of machine learning models and optical character recognition (OCR) software.

As a first step, RPA works with machine learning classifiers, as well as OCR APIs to identify and classify the subject of the request or document, extract all relevant data, and enhance with meta-data like timestamps. Based on trained rules, RPA then performs straight-through processing including direct execution of the necessary changes in the appropriate management, SaaS and IT systems with all necessary tracking, security and approval controls maintained without the need for human intervention.

RPA KEY SUCCESS FACTORS

Define the problem and the best candidates for RPA: Identify highly repetitive rules-based tasks that involve an interaction with one or more different applications.

Align automation roadmap with IT strategy: Most large organizations have established a “Center of Excellence” focused on defining best practices and standards for development projects like RPA. These organizations will offer essential guidance and pre-approved modules for tasks involving confidential data and security controls like user logins. To assure your RPA strategy’s long term success, it is essential that you adhere to the same architectural rigor that your development and IT teams follow.

Start small but think big: Many firms that consider RPA often get bogged down when automation discussions begin. Teams start looking at a bloated process then focus on streamlining the backend, only to get bogged down in organizational inertia and bureaucracy that increases cost and timelines. Agile organizations can act quickly and adjust based on business challenges. Start your RPA journey by identifying small use cases that will enable your organization’s overall strategy to become a more agile customer centric organization.

Embed RPA in your firm’s change management framework: Many RPA projects fail when they move beyond the Proof-of-Concept phase. This is often a result of the development approach, which is initiated, funded and lead by the business and not IT. A key success factor in any RPA project is the alignment of stakeholders across the organization to assure adherence with all regulatory and compliance standards.

GETTING STARTED WITH RPA

GETTING STARTED WITH RPA

West Highland Support Services helps clients in the banking and financial services industry define and implement their automation strategy; enabling an agile approach to identifying RPA/AI candidates to quickly reap the benefits of these powerful technologies. WHSS helps our clients with assessing internal processes, establishing a formal proof-of-concept for each use case, recommending the most suitable tools, along with working with all client stakeholders and business standards to implement and operationalize our RPA solutions.

ABOUT WEST HIGHLAND SUPPORT SERVICES

West Highland Support Services is a vendor-agnostic managed service provider, recognized globally as an industry authority and thought partner for market data, referential and professional services for over 20 years.

West Highland is referred to as “The Gold Standard” for managing, installing and architecting robust market data platforms. We continue to lead the industry with innovative tools and services that increase visibility, manage capacity and maximize uptime while reducing overall operating expense.